NBA’s global stars usher in new era as LeBron, Steph, KD fade into the background

A Serbian, a Canadian, a Slovenian and a Greek fellow walked into a bar … Well, they’ve actually walked into the NBA and now…

New deals have come in thick and fast since the 2015 NFL free agency window opened, plunging the news cycle into something akin to an accountant’s wet dream.

Making heads or tails of the league’s byzantine contract structures can be a headache even for seasoned observers.

The main thing to understand is that even though most contracts aren’t fully guaranteed, it’s extremely hard for a team to get out from under a short-sighted offer.

First, some revision.

Most player contracts are paid out in two forms: an annual base salary, and a prorated signing bonus. Base salaries simply play out as advertised, as the player receives a certain amount of cash which is then counted against the team’s salary cap.

Signing bonuses are slightly more complicated. The player receives the entire contract’s signing bonus in year one, but the team is allowed to spread the cap hit created by a signing bonus over a maximum of five years.

Handing out large signing bonuses is a common tactic used by teams to fit expensive players into a tight cap situation, but it’s not a get out of jail free card. In reality, they’re far friendlier to the player.

Players love large bonuses because they mean plenty of pocket money in the first year, but they also receive greater career security as a by-product. This is because signing bonuses are tattooed onto a team’s books as soon as the deal is signed because the money’s already been given to the player.

As in real life, these tattoos carry a certain level of permanence, and can be extremely painful to remove.

If a team opts to cut a player before his entire signing bonus has counted against the cap, it generates dead money on their books. The greater this financial pain is for the team, the more likely it is to honour the entire contract, or offer the player a generous restructure (more on that later).

Here’s an example as way of explanation. Imagine a hypothetical team with a poor track record of cap management called, say, the San Francisco Pirates. The Pirates become illogically smitten with 28-year-old Madden phenom Eric George, and offer him a five year, $100 million contract split evenly between base salary and signing bonus.

In reality the year-to-year base salary in a contract tends to rise and fall based upon the team’s cap outlook, but for simplicity’s sake in this case the deal is as follows:

| Year | Base salary | Signing bonus | Cap hit | Dead money (pre-June 1) |

| 2015 | $10,000,000 | $10,000,000 | $20,000,000 | $50,000,000 |

| 2016 | $10,000,000 | $10,000,000 | $20,000,000 | $40,000,000 |

| 2017 | $10,000,000 | $10,000,000 | $20,000,000 | $30,000,000 |

| 2018 | $10,000,000 | $10,000,000 | $20,000,000 | $20,000,000 |

| 2019 | $10,000,000 | $10,000,000 | $20,000,000 | $10,000,000 |

Dead money can be a difficult concept to understand, but the calculation is quite simple. It equates to the amount of money guaranteed by the contract that has not been counted as a cap hit at the point when a player is cut or waived.

That remaining money is compiled into one ugly hit and counted against the team’s cap figure for the following season.

To establish the cost of removing a player, add up the remaining bonus money owed, throw in any guaranteed base salaries not yet paid, and there’s your pain. The above example contained no guaranteed base salary, and the dead money calculation assumed the player was cut before the start of June.

If the Pirates realised they’d made a huge mistake after the first year of the deal and cut me George before the start of the 2016 season my his cap hit would double from the already ugly figure of $20 million. On the bright side, the absurd contract becomes nothing more than an embarrassing memory after that season.

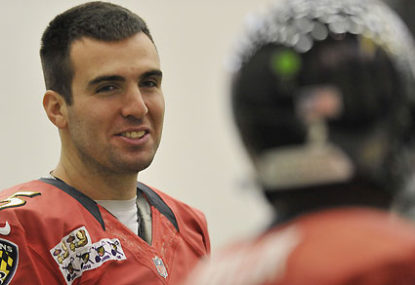

Shifting away from hypothetical Pirates, the dangerous nature of poorly structured contracts can be explained with the very real deals signed by Joe Flacco and Ndamukung Suh.

No recent contract has attracted more hot takes than Cool Joe’s, and it’s easy to see why with cap hits in 2016 and ’17 hovering around $30 million.

| Year | Base Salary | Signing Bonus | Cap Hit | Dead Money |

| 2013 | $1,000,000 | $5,800,000 | $6,800,000 | |

| 2014 | $6,000,000 | $8,800,000 | $14,800,000 | |

| 2015 | $4,000,000 | $10,550,000 | $14,550,000 | $36,400,000 |

| 2016 | $18,000,000 | $10,550,000 | $28,550,000 | $25,850,000 |

| 2017 | $20,600,000 | $10,550,000 | $31,150,000 | $15,300,000 |

| 2018 | $20,000,000 | $4,750,000 | $24,750,000 | $4,750,000 |

The story of the above table is fairly obvious. The Ravens signed Flacco to a six-year deal that averaged out at $20 million annually, roughly equivalent to the deals signed by the league’s top tier quarterbacks.

The problem was that the cash-strapped Ravens pushed the majority of the pain into the final years of the deal with an escalating base salary and multiple bonuses

A common refrain when Flacco signed the deal was that it really represented a three-year contract, as both parties knew a restructure would arrive before Flacco inflicted those mammoth cap hits upon the Ravens.

Whilst this analysis remains correct, the realities of a restructure still leave the team in quite a financial bind.

A team can ask a player to rework a deal to provide them with some cap flexibility by converting some of the remaining base salary into a signing bonus.

In Flacco’s case, this would help the Ravens by taking some of his 18 million dollar salary in 2016 and spreading the cap hit out over multiple years. Don’t forget, that bonus is paid upfront to the player, so he isn’t out of pocket.

The problem is that the prorated bonuses of the original deal aren’t going anywhere, they’ll simply stack on top of the new signing bonuses created by the restructure.

Restructures aren’t a way to make the pain go away, they’re simply a way to put it on lay-by.

Assuming Flacco restructures his deal after the 2015 season as expected, the Ravens will have to deal with a cap hit of $84.45 million due over following three years.

To avoid paying drastic overs, they ideally need that number to drop to around 20 million dollars a year, which can only be achieved by stretching the money into a fourth year, as follows.

| Year | Base Salary | Signing Bonus | Cap Hit | Dead Money |

| 2016 | $1,000,000 | $10,550,000

(+$10,000,000) |

$21,550,000 | $65,850,000 |

| 2017 | $3,000,000 | $10,550,000

(+$10,000,000) |

$23,550,000 | $45,300,000 |

| 2018 | $6,000,000 | $4,750,000

(+$10,000,000) |

$20,750,000 | $24,750,000 |

| 2019 | $12,250,000 | (+$10,000,000) | $22,250,000 | $10,000,000 |

There are plenty of ways of tweaking the numbers, perhaps to push more salary into later years when the cap is expected to skyrocket, but there are a few hard truths that can’t be changed.

The first, and most obvious, is that this restructure assumes Flacco would essentially be willing to play pro bono for a season in exchange for greater security.

This is almost certainly not going to happen, as Flacco holds all the cards in this situation. The Ravens would absorb a ghastly dead cap figure if they opt to waive their QB in an attempt to dodge the big cap hits coming down the track.

Cutting Flacco prior to the 2016 season would save Baltimore three million dollars, hardly an enticing reason to part ways with your franchise quarterback. As such, he knows the team can’t cut him until the final year of the deal, and it can’t afford to ride it out as presently structured.

If the Ravens want to restructure the contract, they’re going to have to shell out some more money. A lot more.

The above numbers represent a four year, 58.5 million dollar deal. By 2018 the NFL salary cap is expected to sit at around $170 million, almost $50 million higher than when Flacco signed his current contract.

Any player agent worth their salt would argue long and hard that the $20 million dollar average that Flacco originally received simply won’t cut it as the cap, and player contracts, continue to inflate.

Simply generating a per-year figure of $24 million would equate to a 5 year, $120 million contract. That’s more than double what Flacco’s earning over the final years of the current agreement!

The Ravens will essentially have to create another contract almost identical to the one that generated this mess, only with a higher per-year average.

And to top it all off, consider the guaranteed money. The extremely generous hypothetical four-year restructure created above already results in some nightmarish dead cap numbers.

Flacco and his agent should use their leverage to demand guaranteed salaries that stretch well beyond the next three years to ensure he gets his hands on as much of the new money generated by the restructure as possible.

The Ravens are already well aware of how much dead cap hits can hurt, as the team will carry $20.66 million in dead money into the 2015 season (a figure certain to rise by the end of preseason). In fairness, almost half of this comes courtesy of Ray Rice’s deal and a potentially unforeseeable set of circumstances.

But some teams, it seems, don’t learn. Miami’s dead cap figure sits today at almost $19 million after the team traded away Mike Wallace and his horrendous contract. This is largely thanks to a recent history spent splashing out on large free agency contracts (like Wallace) that lead to regret sooner rather than later.

Despite committing almost a seventh of their cap to players who won’t play in 2015, the ‘Fins blew the doors off of free agency this year with an eye-popping deal for bad boy defensive tackle Ndamukung Suh.

| Year | Base Salary

(guaranteed) |

Signing bonus | Cap hit | Dead money |

| 2015 | $985,000

$985,000 |

$5,100,000 | $6,100,000 | $59,955,000 |

| 2016 | $23,485,000

$23,485,000 |

$5,100,000 | $28,600,000 | $53,870,000 |

| 2017 | $9,985,000

$9,985,000 |

$5,100,000 | $15,100,000 | $25,285,000 |

| 2018 | $16,985,000 | $5,100,000 | $22,100,000 | $10,200,000 |

| 2019 | $18,985,000 | $5,100,000 | $24,100,000 | $5,100,000 |

| 2020 | $18,360,000 | $0 | $18,375,000 | $0 |

Five years, $114.375 million with almost $60 million guaranteed: that’s an eye-watering figure for a defensive lineman.

By comparison, JJ Watt’s huge deal last year delivered him an average of less than $17 million a year, with only $20.8 million guaranteed.

Watt has already won two defensive MVP trophies in his first four seasons. Suh? Yet to poll a single vote despite entering the league a year earlier.

If $28 million is too much for the Ravens to swallow for their franchise QB, it seems bizarre that the Dolphins could accept that figure in the second year of a contract for a DT.

This is a case, however, where the deal could realistically end up being half as long as advertised.

By cutting Suh before the 2018 season the Dolphins would save $12 million. Miami has signed up for an inversion of Flacco’s contract: guaranteed immediate pain with no real hope of a restructure and the option to get out halfway through with some shred of financial dignity.

This may seem like a positive alternative, but in reality it would just mean more cap hell for a team addicted to overpaying in March.

As the dust settles after the most dramatic free agent period in recent memory, have a good look at the deals your team closed, or passed up. It’s fun to get caught up in the hype of a splashy signing, but the financial realities of foolish contracts will catch up with a team sooner or later.